A GCash user would encounter the “Wallet Cap Exceeded” message when attempting to transact in the GCash mobile app beyond his or her monthly limit. There would also be a corresponding text message notification from 2882 which would appear to be something like, “Sorry, you will exceed your transaction limit. Please try a smaller amount.”

A Basic Member level in GCash has a transaction limit of PhP50,000 monthly while a Fully Verified Member can have incoming and outgoing transactions of up to PhP100,000 monthly. One person can have multiple GCash accounts, but GCash may as well mean the transaction limits apply to one person nothwithstanding the number of GCash accounts.

My GCash account shows up as Fully Verified in the GCash mobile app.

But every time I check my transaction history after the third week of the month, I would find my online purchase/ATM withdrawal/send money to another GCash user attempts would be halted when the amount hits PhP50,000.

Few years ago my sister had inquired about this with the support team at a Globe center and she was told my Fully Verified account is good for a PhP100,000 monthly transaction limit.

I recently am having this problem again and decided to send an e-mail to GCash Support earlier today to clarify.

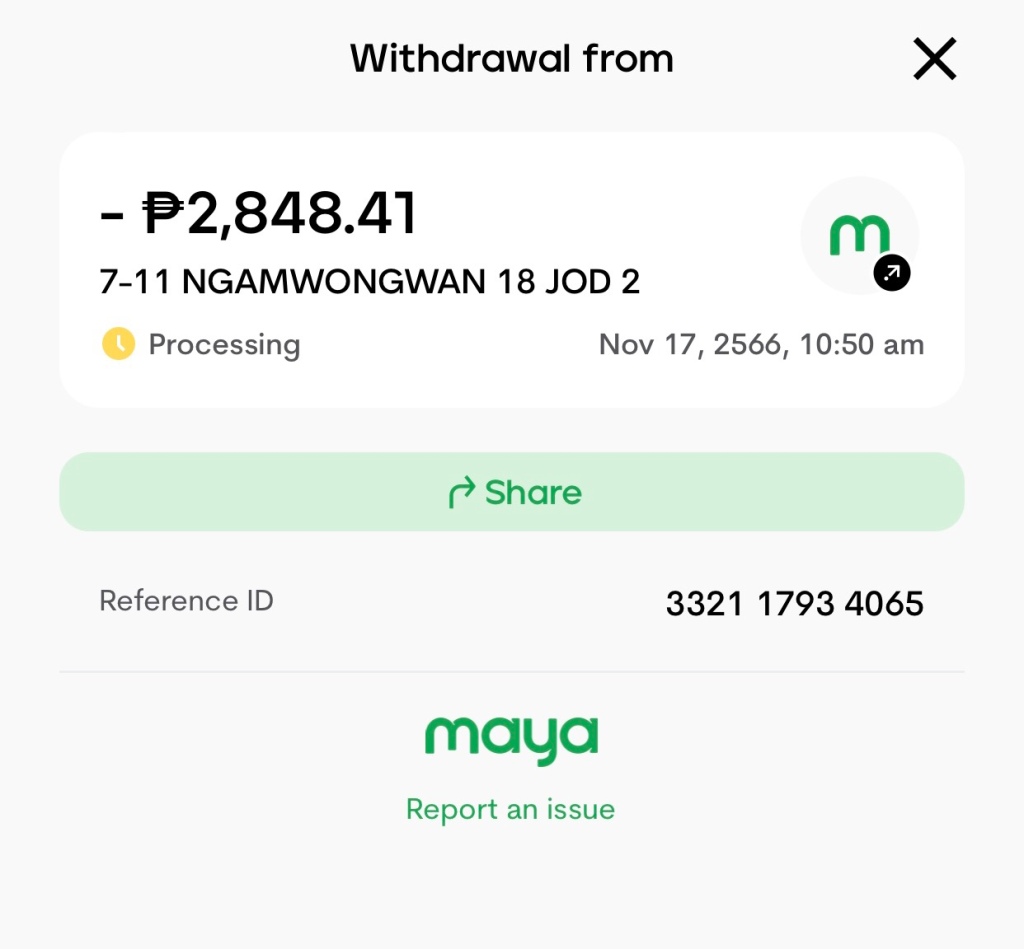

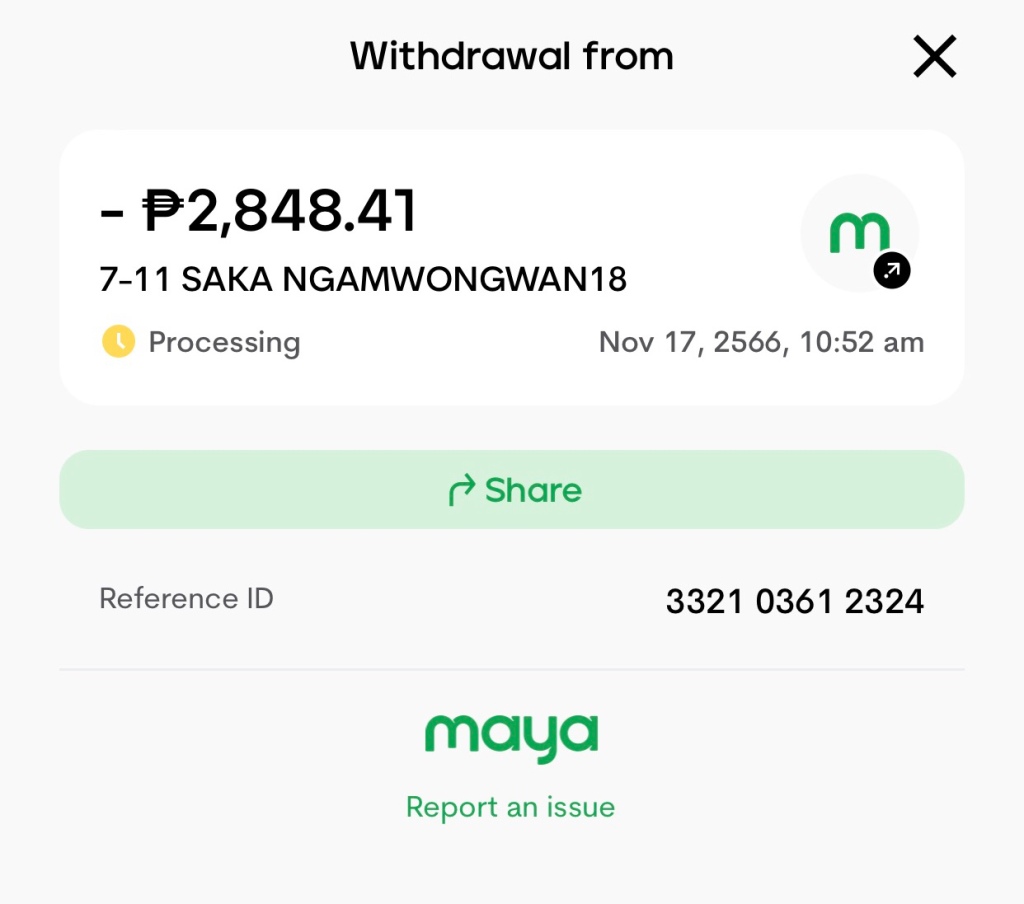

Here’s what my GCash MasterCard and GCash AmEx statements currently looks like:

Hope GCash support can clarify.

UPDATE: MAY 14, 2019

GCash Support could not give me a clear answer at first until I pestered them to stop sending me templates which does not address my question properly.

I was then told that as a Fully Verified member I am allowed the PhP100,000 monthly transaction limit. What this means is if I cash in PhP50,000 plus worth in a month, I would have already reached my monthly transaction limit if I spend or transact away all of that amount from ATM withdrawals, bank transfers, money transfers to other GCash numbers, online purchases, shopping, etc. PhP50,000 cashed in and PhP50,000 cashed out equals PhP100,000.

I wish they would rectify the transaction limit table. Wallet Size makes it confusing as it can be misinterpreted as PhP100,000 allowable cash-in.

That clears up the GCash wallet cap exceeded issue. It’s still a good idea to either have multiple GCash accounts and get a PayMaya account, too.